Performance and Security for Financial Operations

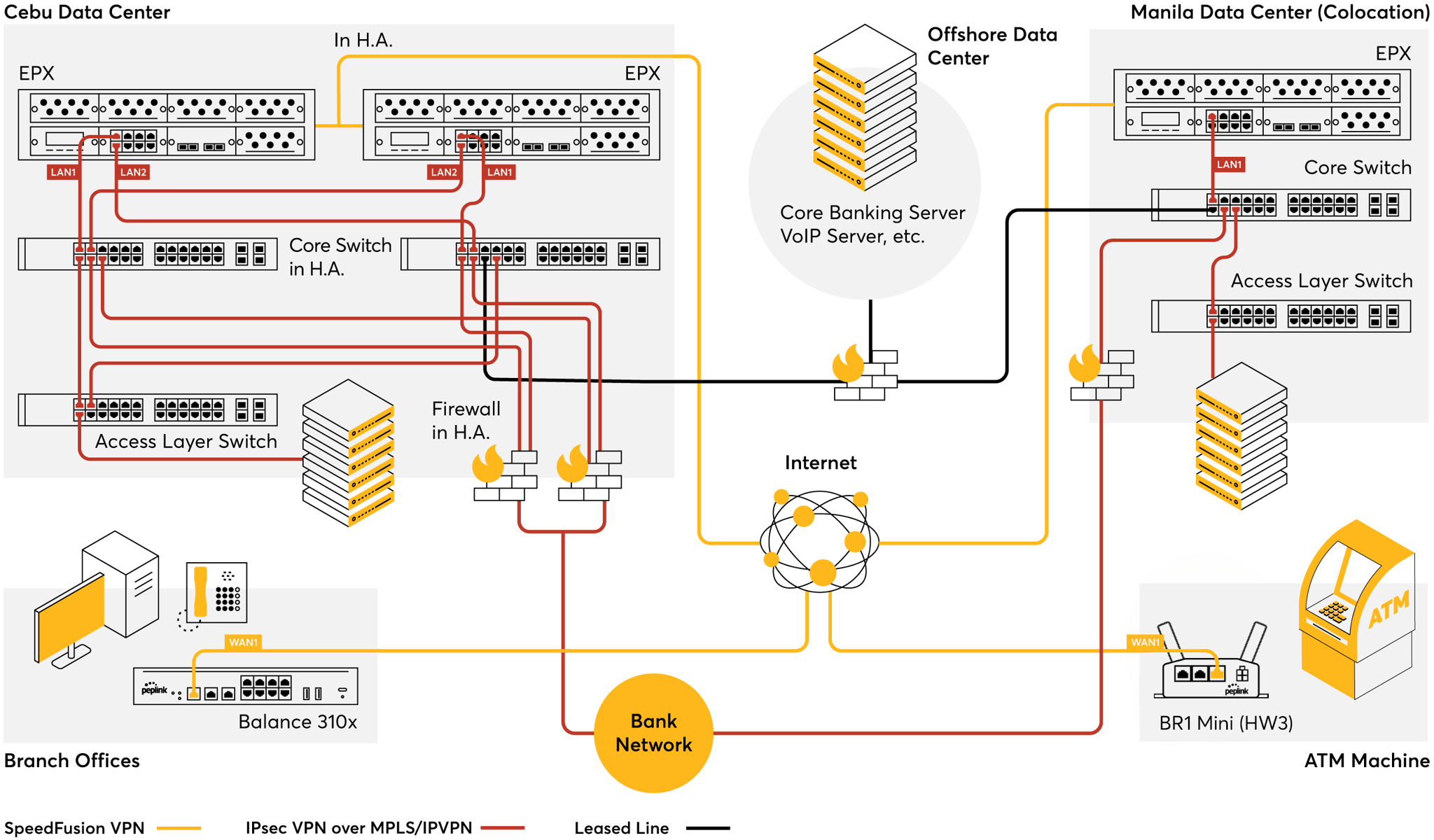

Financial organizations require consistent performance, low latency, and continuous availability to support transactions, communications, and regulatory obligations. Paygasus Connect delivers SD-WAN engineered for banking, fintech, and data-intensive financial environments, supporting secure connectivity across branches, ATMs, trading floors, cloud platforms, and remote teams.

- End-to-end encrypted communications using AES-256 VPN tunnels

- High-availability network architecture with automatic failover to maintain transaction continuity

- Scalable connectivity across branch offices, data centers, cloud workloads, and mobile financial teams

- Zero-trust network design supporting identity controls and multi-factor authentication